🪙 Financial Freedom on a Tight Budget: A Realistic Guide for Families Living Paycheck to Paycheck

For many hardworking families—especially those juggling small jobs, raising children, or caring for elderly parents—financial independence can feel like a distant dream. But here’s the truth: you don’t need a big salary to build a secure future. What you need is a plan, discipline, and a few smart habits that can turn your limited income into long-term stability.

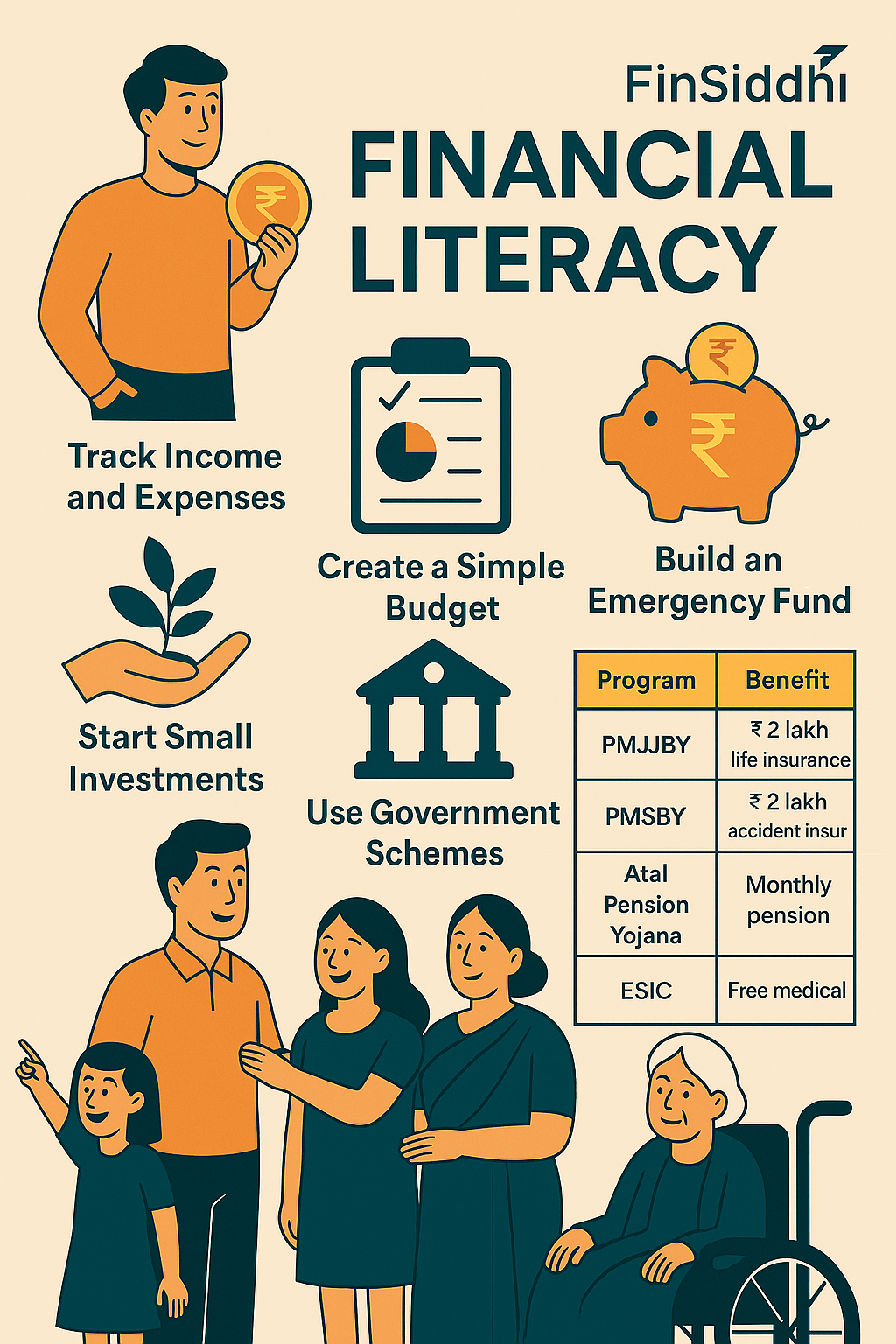

💡 Why Financial Literacy Matters (Especially for Low-Income Families)

- Emergencies don’t wait: A medical bill, job loss, or home repair can derail your life if you’re unprepared.

- Children and parents depend on you: Your financial decisions today shape their tomorrow.

- Peace of mind: Knowing you have a plan reduces stress and helps you focus on what matters most—your family.

📊 Step-by-Step: How to Take Control of Your Money

1. Track Every Rupee

Start by writing down all your income and expenses. Use a notebook or a free mobile app. This helps you:

- See where your money is going

- Identify unnecessary spending

- Set realistic savings goals

📝 Tip: Even ₹10 saved daily adds up to ₹3,650 a year.

2. Create a Simple Budget

Follow the 50-30-20 rule (adjusted for low income):

- 70% for needs (food, rent, transport)

- 20% for savings/emergency fund

- 10% for wants (entertainment, small treats)

If 20% savings feels impossible, start with 5%. The habit matters more than the amount.

3. Build an Emergency Fund

Aim for at least ₹5,000–₹10,000 as a starter emergency fund. Keep it in a separate bank account or a secure savings scheme like:

- Post Office Recurring Deposit

- Sukanya Samriddhi Yojana (for girl children)

- PM Jan Dhan Yojana (zero-balance accounts)

4. Use Government Schemes

India offers several helpful programs: | Scheme | Who It Helps | Benefit | |——-|—————|———| | PMJJBY | Adults 18–50 | ₹2 lakh life insurance for ₹330/year | | PMSBY | Adults 18–70 | ₹2 lakh accident cover for ₹12/year | | Atal Pension Yojana | Workers in unorganized sector | Monthly pension after 60 | | ESIC | Low-income workers | Free/subsidized medical care |

5. Start Small Investments

Even with ₹100–₹500/month, you can invest:

- Recurring Deposits (safe and fixed returns)

- Mutual Funds via SIPs (start with ₹100/month)

- Gold Savings Schemes (for future weddings or emergencies)

📈 Investing early—even in small amounts—beats saving late.

6. Avoid Bad Debt

- Don’t borrow for luxuries.

- Avoid payday loans or informal lenders with high interest.

- If you have existing debt, pay off the highest-interest one first.

👨👩👧👦 Special Tips for Families with Kids or Elderly Parents

- Buy health insurance: Medical costs are rising. Even basic coverage can save lakhs.

- Teach kids about money: Use piggy banks, involve them in budgeting.

- Talk to your parents: Understand their needs, help them access pensions or senior citizen benefits.

🌱 Final Thoughts: Small Steps, Big Impact

You don’t need to be rich to be financially wise. You just need to be consistent. Start with what you have, where you are. Every rupee saved, every smart choice made, brings you closer to a future where you’re not just surviving—but thriving.

The information provided in this article is intended for general awareness and educational purposes only. It does not constitute financial, legal, or investment advice. Readers are encouraged to consult with a certified financial advisor or relevant government authority before making any financial decisions or relying on the content shared here. While efforts have been made to ensure accuracy, FinSiddhi and the author are not responsible for any losses, damages, or actions taken based on this information. Government schemes, eligibility, and benefits may vary by region and are subject to change.